With proposed tax changes looming, 2021 might be the last year for this key tax-savings strategy for high earners.

Time to Read: 13 Minutes

The backdoor Roth gives high earners access to a tax-free Roth IRA. It can protect from rising taxes, give flexibility in retirement, and provide more for loved ones. However, a backdoor Roth IRA isn’t right for everyone, and done incorrectly it can run up a hefty tax bill. At Stratos Private Wealth, we guide clients through every step from understanding their options to ensuring a smooth experience.

Before we get started, let’s define what a backdoor Roth IRA is.

What is a backdoor Roth?

A backdoor Roth is a way to get money into a Roth IRA for high earners who can’t directly contribute.

For 2021, direct Roth IRA contributions phase out at incomes between $198,000 – $208,000 for married couples and $125,000 – $140,000 for individuals. This is where the backdoor Roth comes in. While there is an income limit on direct contributions, there is no income limit on converting a Traditional IRA or 401(k) into a Roth IRA.

How does a backdoor Roth work?

Typically, a backdoor Roth starts with making a non-deductible contribution to a traditional IRA. The investor will then complete a Roth conversion on the traditional IRA to transfer into a Roth IRA.

Ideally, there are no tax consequences. While the investor won’t get a tax break on the traditional IRA contribution, there will also be no taxes from the Roth conversion.

The backdoor Roth works best if you don’t have any pretax traditional IRAs. When doing the Roth conversion, you can’t pick and choose which assets are converted. The IRS forces you to convert a proportionate amount of your traditional IRA balances, meaning your non-deductible contributions will be lumped together with any pretax assets (taxable on conversion). Later in this article, we’ll discuss this in more detail along with some ideas to reduce these taxes.

Some 401(k) plans also allow for the special mega backdoor Roth strategy. This allows you to save even more than the traditional approach without worrying about taxes. We’ll discuss how this works below.

What is the advantage of a backdoor Roth?

Unlike a Traditional IRA, which only delays taxes, a Roth IRA is tax free. In a Roth IRA, investors save after-tax money (which means taxes are paid on the money initially contributed), but in exchange they won’t pay another dime of taxes when taking out money in retirement.

There are three major advantages to a backdoor Roth IRA: protection against rising taxes, flexibility in retirement, and leaving more to heirs. At Stratos Private Wealth, we design personalized financial plans through our eMoney planning software that show clients, in real dollar terms, how much they will benefit in each of these areas.

Protection against rising taxes

Benjamin Franklin famously wrote that “in this world nothing can be said to be certain, except death and taxes.” While we know there will be taxes in the future, the uncertainty arises because the tax rate can change rapidly and dramatically.

This is a very real concern right now for many of our clients. The historically low income tax rates from the Tax Cuts and Jobs Act are scheduled to sunset in 2026. President Biden campaigned on higher taxes (including raising the top marginal bracket and capping itemized deductions) that could take effect even sooner. The unprecedented federal spending on COVID-19 stimulus will also pressure Congress to raise taxes to rein in the ever-widening budget deficit.

Investors can save on future taxes by contributing after-tax dollars to a Roth IRA. They are locking in today’s low taxes and shielding their money against higher taxes down the road.

Flexibility in retirement

Another major advantage to a backdoor Roth IRA is flexibility. Starting at age 72, taxpayers are required to withdraw from Traditional IRAs and 401(k)s, regardless of actual living expenses. These are called RMDs (Required Minimum Distributions). (There is an exception on 401(k)s for those who are actively working after age 72 and own less than 5% of the business.)

Roth IRAs, on the other hand, don’t have RMDs. As a result, retirees can take as much or as little as they want each year. They can also choose to leave their Roth IRA growing tax free.

This has important tax implications. For retirees with large traditional IRAs, RMDs can push them into a higher marginal tax bracket. This can bump up Medicare premiums and subject a larger percentage of Social Security benefits to taxes.

Leaving more to heirs

Finally, a backdoor Roth IRA can allow affluent investors to leave more to loved ones. With no RMDs, the funds can be set aside for future generations and allowed more time to grow.

Roth IRAs also don’t subject heirs to taxation. With the SECURE Act, this has become even more important. While payments from inherited Traditional and Roth IRAs previously could be stretched over the beneficiaries’ lifetime, the SECURE Act requires that all inherited IRAs (aside from those inherited by spouses, disabled individuals, and a few other exceptions) be fully distributed in 10 years. For large traditional IRAs, this creates a sizeable tax bill for the beneficiaries, who may not need the funds all at once. A Roth IRA, on the other hand, allows the beneficiaries to pay no income taxes.

A backdoor Roth IRA can also reduce estate taxes. Because after-tax funds are used, taxes are essentially paid “up front.” This takes the amount of income taxes out of the equation and no longer subjects them to the hefty 40% estate tax rate.

While the exemption sheltered from estate taxes is currently $11,700,000 per person ($23,400,000 per married couple) in 2021, it will sunset back to $5,000,000 per person (adjusted for inflation) starting in 2026. This could, however, change even sooner. The increased federal spending for COVID-19 mentioned above also threatens to bring higher estate taxes for successful families.

Is a backdoor Roth right for me?

Before deciding whether to use the backdoor Roth strategy, an investor needs to understand the pros and cons. This strategy brings important implications for taxes, retirement income, estate planning, and investments.

At Stratos Private Wealth, we have the tools and expertise to give clients clarity and understanding when it comes to a backdoor Roth IRA. We design a financial plan based on your current and anticipated tax situation to see the possible savings that a backdoor Roth IRA could bring to your retirement and your estate plan.

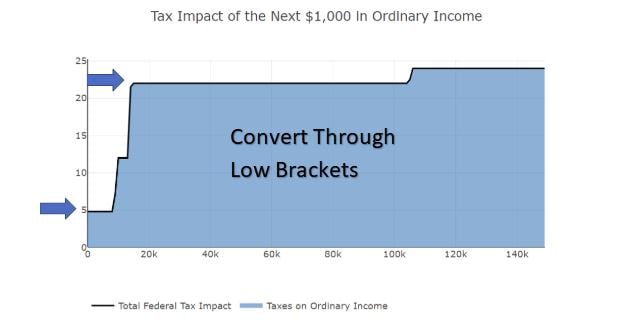

Our Holistiplan software also models the impact of a Roth conversion in an easy-to-read, visual format. This gives clients clarity on whether to move forward with a backdoor Roth IRA contribution or wait until a year in which taxes will be lower. For individuals experiencing a lower-than-usual tax year (such as caused by a large realized loss, gap in employment, or generous charitable gift), there may be opportunity to Roth convert traditional IRA assets up through the lower tax brackets.

We also understand the important role that our clients’ other professional advisors play in their wealth management decisions. As a result, we partner closely with our clients’ CPAs and other tax advisors through every step of this process.

To determine whether a backdoor Roth IRA could be a good fit, there are other factors to consider. These include current and anticipated future taxes, existing pretax traditional IRAs, and the availability of the mega backdoor Roth IRA strategy. We’ll discuss all these in the next sections.

Who should do a backdoor Roth?

A backdoor Roth is ideal for individuals who expect higher taxes in the future. A Roth conversion is especially tax-savvy in years with lower-than-usual taxes. Younger workers with decades until retirement benefit the most.

A backdoor Roth IRA also works best for individuals with little or no Traditional IRA assets. Because of the IRA Aggregation Rule, the IRS will lump all Traditional IRA assets together and force you to Roth convert on a pro-rata (proportionate) basis. This can make the backdoor Roth strategy much more expensive.

When can you not do a backdoor Roth?

A backdoor Roth conversion is not for everyone. The most important consideration is when the investors have large traditional IRAs. You cannot selectively pick and choose which traditional IRA assets to convert to a Roth IRA. In what is called the IRA Aggregation Rule, the IRS will lump together all traditional IRA assets, even those held in separate accounts or separate custodians.

Some investors with after-tax (non-deductible) contributions in their traditional IRAs, which can be withdrawn or Roth converted without owing anything to the IRS. However, when investors try to convert only these non-taxable amounts, the IRS forces them to include a proportionate amount of after-tax and pre-tax amounts.

For example, if an investor has a $500,000 traditional IRA with $494,000 of pre-tax contributions and earnings and a $6,000 non-deductible portion, she wouldn’t be able to Roth convert only the $6,000. The entire $500,000 would be lumped together. This means that 98.8% ($494,000/$500,000), or $5,928, of a $6,000 Roth IRA conversion would be subject to taxes.

The IRA Aggregation Rule only applies to other IRAs (Traditional, SIMPLE, and SEP IRAs). 401(k)s and other employer-sponsored accounts are not included. As a result, some investors can avoid the IRA Aggregation Rule through an “escape hatch” in their 401(k)s. Some company retirement plans allow participants to roll in traditional IRA assets from previous employer plans. Investors can transfer untaxed money out of a traditional IRA and then Roth convert just the remaining after-tax amounts.

Another consideration is whether investors expect their income to fall. Earning an unusually generous commission or selling a property owned for a long time can inflate your income up to a higher-than-normal tax bracket. This can make a backdoor Roth conversion more expensive, especially for investors with large traditional IRAs under the IRA Aggregation Rule. Investors who expect their income to drop should consider waiting.

To get around the IRA Aggregation Rule, some investors can make a mega backdoor Roth contribution through a 401(k).

What is a mega backdoor Roth?

Certain workers can take advantage of the mega backdoor Roth, which hypercharges your contribution and exempts you from the IRA Aggregation Rule. A mega backdoor Roth is funded through a 401(k) that meets certain requirements.

It starts with regular employee contributions. Many 401(k)s allow workers to save up to $19,500 ($26,000 after age 50) in a Roth account, regardless of your income.

On top of these savings, some plans allow for after-tax (also called non-deductible) contributions. Withdrawals of these after-tax savings are not taxable, but any growth earned on your original contributions will be subject to taxes.

This is where the mega backdoor Roth strategy comes into play. Like the regular backdoor Roth strategy, these after-tax savings can be transferred to a Roth IRA tax-free. For employer plans that allow in-service withdrawals (distributions from your 401(k) while you are still working), you can roll the after-tax savings into a Roth IRA to make sure that your contributions and the earnings are all tax free.

The amount that can be saved in a mega backdoor Roth strategy is based on your age and your employer’s contributions. The IRS allows a total of $58,000 ($64,500 over age 50) to be saved in a 401(k) for 2021. With no employer contributions, a worker can save as much as $38,500 in 2021.

To find your maximum mega backdoor Roth contribution amount, take your regular employee savings of $19,500 ($26,000 over age 50) in a pre-tax or Roth account, add your employer’s matching and any profit-sharing benefits, and subtract from the IRS limit. For example, a 53-year-old employee who saves $26,000 to her Roth 401(k) and receives a 4% match on her $250,000 salary ($10,000) could save up to $28,500 ($64,500 minus $36,000) in after-tax savings.

Where available, the mega backdoor Roth strategy gives top earners the most tax-efficient way to save in a Roth IRA.

Is a backdoor Roth worth it?

Should you take advantage of the backdoor Roth strategy? The answer depends on your unique circumstances. Our team at Brown Wealth can help answer this question with certainty through a personalized, comprehensive financial plan. We evaluate factors such as these below:

- Can you access the mega backdoor Roth strategy through your 401(k)? The mega backdoor Roth strategy allows for a higher, tax-free savings option and is the best place to start.

- What tax bracket do you anticipate in retirement? If you expect large taxable inflows in retirement, such as passive business income, a Roth IRA could help prevent future taxes.

- What other sources of income do you have? If most of your retirement savings is in 401(k) or traditional IRA assets, you may experience high taxes from RMDs (Required Minimum Distributions) without a Roth conversion. On the other hand, if you have non-taxable or low taxable income, such as after-tax accounts with a high cost basis or rental properties with significant depreciation, you won’t benefit as much in retirement from a Roth IRA.

- What are your goals with leaving an inheritance to loved ones? A Roth IRA can be a tax-efficient vehicle to leave your heirs.

What else should I know?

What is the max Roth contribution for 2021?

For 2021, the IRA contribution limit is $6,000 ($7,000 over age 50). For married couples, each spouse can save up to this limit, even if only one is working.

This limit applies to traditional IRA contributions that will be converted to a Roth IRA. For existing traditional IRA assets, there is no annual limit to how much can be converted to a Roth IRA.

How often can I do a backdoor Roth?

The backdoor Roth strategy is always available. While there is the annual limit for investors planning to contribute first to a traditional IRA, you can convert any existing traditional IRA assets to a Roth IRA at any time.

Can anyone do a backdoor Roth?

For a non-deductible contribution to a traditional IRA, the backdoor Roth strategy is available to anyone with earned income and at any age. Anyone else can Roth convert any existing traditional IRA or 401(k).

Can you still do a backdoor Roth in 2021? Will the backdoor Roth be eliminated?

For years, the IRS was silent on the backdoor Roth strategy. This concerned many investors who feared that it would become unavailable, or worse still, that the IRS would deem the backdoor Roth as an excess contribution and charge penalties. However, in 2017 Congress officially recognized this strategy by recording it the Tax Cuts and Jobs Act Conference Report (footnote 269). Investors can now have peace of mind when using this strategy.

Working with Stratos Private Wealth

While a backdoor Roth can shield savings from taxes, provide more flexibility in retirement, and leave more for loved ones, it isn’t right for everyone. The benefits must be carefully weighed against any potential tax bill. Timing can also play a key role in when to use this strategy.

We can help guide you in making these decisions. Our financial planning tools provide a detailed analysis of the tax impact of a backdoor Roth strategy, as well put in real dollar terms the benefits you might receive through the strategy in retirement and for your loved ones. We will coordinate this analysis with your other professional advisors to ensure this strategy fits with the rest of your wealth management plan. Our dedicated staff of financial planners will also examine other options to help you achieve your financial goals and live your richest life. Contact our office for a free consultation today.