Time to Read: 17 Minutes

We live in a “golden age” for estate planning: high federal gifting limits, low interest rates, and no capital gains on inherited assets. However, this may change soon.

The generations-high gifting exemption ($11.7 million per person and $23.4 million per couple in 2021) will sunset at the end of 2025. And with the record-breaking COVID-19 stimulus, tax hikes have been proposed to lower this even sooner and fill in the budget deficit. There have also been proposals to raise capital gains taxes and eliminate the step-up in basis after death, eroding what is left to your heirs.

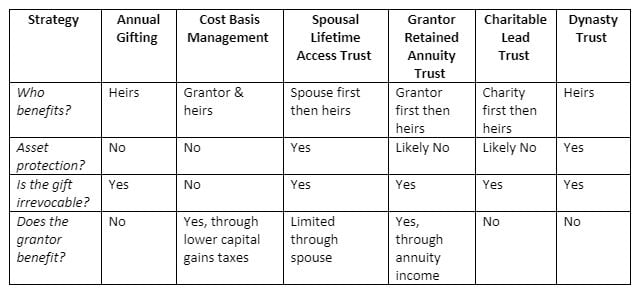

How can affluent families prepare for possible tax hikes? We’ll consider 5 strategies to give more in this “golden age.” More importantly than simply avoiding taxes, however, these strategies allow families to accomplish what is truly important to them, whether leaving more to family and charity, retaining control of their estate, or providing an income stream in retirement. We guide families in understanding the pros and cons of these and other strategies to live to the fullest.

This article is meant as a brief introduction to these strategies, not a recommendation. Before implementing any of these ideas into your estate plan, consult your tax and legal team to understand what is best in your situation.

Idea #1: Annual Gifting

One foundational estate planning strategy for successful families is annual gifting. This is very popular with our clients.

How does this strategy work?

Every year, you can give someone else up to the annual limit ($15,000 for 2021). This gift doesn’t need to be reported, and it doesn’t count against your lifetime gifting exemption. There is no limit to how many people you can gift, as long as each one doesn’t receive more than the limit. You can give appreciated stock, cash, personal property, or any other asset you choose.

Married couples can take advantage of split gifting. This doubles the amount you can give. Each spouse can give up to their gifting limit in a combined gift, for a total of $30,000 per recipient.

Why would I use this strategy?

This is an easy, low-cost way to transfer wealth to future generations. Because you’re making a simple gift, you don’t need a trust or other structure.

Maximizing your annual gifting every year can result in a significant wealth transfer over time. For example, a couple with three married children and six grandchildren could give away $360,000 in 2021. They could give $60,000 to each child and spouse, as well as $30,000 to each grandchild. Over just three years, the couple could transfer over $1 million ($1,080,000 based on the current exemptions).

For the largest tax benefit, consider giving assets with a high unrealized capital gain. You can gift stock and other appreciated assets to loved ones who are in a lower tax bracket. While your cost basis will carry over, your loved one can sell the position and pay less in capital gains taxes than you would.

What pitfalls should I be aware of?

Those using the annual gifting strategy should remember that it is irrevocable. Once you transfer funds to others, you no longer have control over how the funds are used.

Idea #2: Cost Basis Management

What is cost basis management?

Cost basis management involves increasing the tax basis of investments to avoid future capital gains taxes and provide flexibility for yourself and your heirs.

How does this strategy work?

Cost or tax basis is the price paid for an investment. This includes stock, real estate, bonds, and business interests. For certain assets, your basis may not match your sale price exactly. For example, depreciation in real estate and owner’s draws in businesses lowers your basis. When you sell an asset, you pay capital gains taxes on the difference between the sale price and your tax basis.

Cost basis management often involves tax-gain harvesting. Unlike tax-loss harvesting, where you sell positions at a loss to realize a tax loss, tax-gain harvesting involves selling positions at a gain to increase your tax basis. While it may sound counterproductive to realize capital gains intentionally, this allows you to bump up your basis and pay less in gains later. This strategy works best in years with unusually low income, such as from a large charitable gift, gap in employment, or carry forward capital loss. With the current low capital gain rates, now might be a perfect time to consider this strategy.

At Stratos Private Wealth, we can help you plan for managing the basis in your holdings. We can calculate the tax impact now, as well as your what your savings will be over time. We can also guide you in choosing the best positions to sell. For example, we have found that many clients who are holding a concentrated stock position, perhaps from an ESPP or stock options, have a portfolio with much higher levels of risk than they realize. The portfolio may be exposed to sudden, sharp losses if the company experiences a poor earnings quarter. Decreasing this position by selling it in selectively over time may help you diversify the portfolio, which can lower your risk.

Managing cost basis can help protect against tax law changes

Cost basis management gives flexibility without worrying about large capital gains. You can sell the investment at the right time or diversify into other investments without worrying about hefty gains.

Cost basis management also protects against changes in capital gains taxes. The Biden administration has proposed eliminating the special treatment of long-term capital gains. The top bracket would rise from 20% to 39.6%. The step-up in basis at death, which resets the tax basis to market value at your passing, may also be eliminated. Finally, tax-free 1031 exchanges of like-kind real estate property may be limited to $500,000. Should these or similar provisions become law, gains would become more costly.

What pitfalls should I be aware of?

The biggest concern is taxation. Depending on your tax bracket, realizing more capital gains may push you into a higher tax bracket or cause other unintended consequences. These include higher Medicare premiums, exposing your investment income to the 3.8% Medicare surtax, or phasing out certain deductions.

Before making any changes, we recommend a analyzing your portfolio and creating a tax projection to understand the potential impact. Through our Holistiplan software and by working with your tax preparer, we can create a plan for realizing gains that keeps your income below the next marginal tax bracket. We can also partner with your CPA to adjust your estimated tax payments to avoid any unpleasant surprises on Tax Day.

Idea #3: Spousal Lifetime Access Trust

What is a Spousal Lifetime Access Trust?

A Spousal Lifetime Access Trust (SLAT) is a gift from one spouse to a trust for the other spouse. The goal is transferring wealth to children or grandchildren. A SLAT is a flexible way to use the current high gifting exclusion, benefit future generations, keep limited access to funds, and protect against creditors.

How does this strategy work?

One spouse (the donor) gifts assets in a trust to the other spouse (the non-donor). This gift is irrevocable, meaning the donor spouse can’t transfer the funds back. The non-donor spouse is the only one who can access the trust after the gift is made. After the non-donor spouse passes away, the assets will go to children or grandchildren.

By not claiming the unlimited marital gifting exemption, the funds are considered a taxable gift. As long as the gift is below the federal exemption ($11.7 million), however, no gift or estate taxes are due. This gift removes the assets from the estate of both spouses, so no taxes are due at the passing of either spouse.

Unlike similar strategies like a bypass or credit shelter trust, this gift is made while both spouses are alive.

Only one spouse may fund a SLAT, or both may create SLATs for each other. If both create trusts, they need to watch out for the reciprocal trust rules explained below.

Why would I use a Spousal Lifetime Access Trust?

A SLAT can give many benefits. First, it allows you to use up your current high gifting exemption. Instead of waiting until your passing, you can transfer more assets to your family now, while the higher limits are still in place. The donor spouse can transfer up to the full exemption ($11.7 million in 2021) without gift taxes. In addition, any growth in the trust is outside the estates of both spouses and passes estate tax-free to future generations.

While the main goal of a SLAT is benefiting children and grandchildren, the couple can still access the funds as needed. Depending on the terms of the trust, the non-donor spouses can use funds to maintain their standard of living and avoid drawing down other sources of income. This can benefit the donor spouse indirectly while the couple is still living together.

Finally, a SLAT can give asset protection, such as from a lawsuit or bankruptcy. Because the gift is irrevocable, it is outside the reach of creditors. A SLAT can also help prevent elder abuse, as unscrupulous individuals cannot access the funds without the trustee’s permission.

What pitfalls should I be aware of?

Protecting the donor spouse and avoiding divorce issues

While there are benefits to a SLAT, there are important considerations as well. The top is making sure the donor spouse is financially protected. After the non-donor spouse’s death, the funds go to children or grandchildren. As a result, the donor spouse can no longer access the funds. Consider life insurance on the non-donor spouse to protect the donor spouse, if needed.

There is also a concern with divorce. While few newlyweds plan to end their marriages, 15 out of 1,000 married people divorced in 2019. The COVID-19 pandemic is expected to increase both the number and the cost of divorces. To counter this risk, many couples create SLATs on each other. However, you need to be mindful of the reciprocal trust doctrine. This means if both SLATs are basically the same, they could be undone and the assets roped back into the estate. The trusts must be carefully drafted as substantially different: established at different times, left to different kinds of beneficiaries (such as one to children and the other to grandchildren), or contain different withdrawal rights.

Eliminating the step-up in basis

The SLAT strategy also has tax consequences. While you avoid estate taxes, there is no step up in basis at death. This can be a big issue with low basis assets, such as appreciated real estate or stock. However, if the step-up in basis is eliminated, the strategy becomes more attractive.

Ensuring income needs are met

Finally, make sure you can afford the gift and still have other assets for ordinary retirement needs. While the SLAT can be used to support the non-donor spouse, it is primarily for leaving wealth to other family members. What other sources of income do you have available in retirement (including Social Security, pension, rental income, or annuities)? Do you foresee any future need for the principal, such as buying a second home, supporting grandchildren through college, or an extended need for care?

The best way to answer these questions is through a comprehensive financial plan. At Stratos Private Wealth, we help clients map out their likely cost of retirement along with sources of retirement income to cover it. We also “stress test” for any number of unexpected risks, whether from a poor market or a gap in insurance coverage. This can give clients confidence in how much they could give to a strategy such as a SLAT.

Idea #4: Grantor Retained Annuity Trust

What is a Grantor Retained Annuity Trust?

A Grantor Retained Annuity Trust (GRAT) is a trust that leaves assets to your family in a, tax-efficient way that still provides an income stream during your lifetime.

How does this strategy work?

The grantor (person making a gift) will fund an irrevocable trust. The trust is set up to pay the grantor a percentage of the assets in the trust every year, for a fixed period of time. At the end of the term of the trust, the assets in the trust revert to the beneficiaries. The trust is invested in holdings that have the potential for growth, such as stocks.

Any growth after you set up the trust will go to your beneficiaries without any estate or gift taxes. You essentially “freeze” the value of your assets by giving them now before they grow in value.

There are no income taxes on the annuity payments from the GRAT. Because you set up the trust, the IRS sees this income as you transferring money to yourself, which isn’t taxable.

Why would I use a Grantor Retained Annuity Trust?

Unlike many irrevocable trusts which prevent the grantor from ever touching the funds again, a GRAT returns an income stream for a certain period. This can provide cash flow in retirement and ease the cost of making the gift. This works best with young heirs who don’t have a need for the funds yet.

This strategy also works best in times with low federal interest rates, such as we have right now. The applicable federal rate (section 7520) is at 1.0% for September 2021. While this has risen since the start of the year, it is still below historical rates.

The annuity value is based on the federal rate, which may be very different than the actual returns in the investments. When interest rates are lower, it becomes easier to earn a real return that exceeds the “expected” return based on the low rates. All this extra return goes to your family, not the IRS.

What pitfalls should I be aware of?

A GRAT must be coordinated with the rest of your financial plan. Can you afford to transfer the assets out of your estate? Do you have other sources of income to replace the GRAT payments at the end of the term? We can help you answer these important questions through a financial plan. Through our planning software, we can ensure you have enough resources to replace the funds given to the GRAT.

Another important consideration is capital gains. Like the SLAT, there will be no step up in basis for the assets in the trust. This leaves your heirs on the line for paying the capital gains.

The grantor could pass away during the annuity term. If this happens, the GRAT assets would return to the grantor’s estate and be subject to estate taxes. This defeats the purpose of the trust. To avoid this problem, the trust can include a provision that transfers the remaining annuity payments to the surviving spouse. Your estate planning attorney should make sure your GRAT contains the appropriate language.

Finally, the investment allocation plays a key role. If the returns in the trust are lower than the annuity payments, the principal must be drawn down. This leaves less to your heirs. At Stratos Private Wealth, we can help you target an appropriate level of risk in the portfolio. This helps you avoid both large drawdowns in poor markets and underperformance in good ones. We also strategically adapt to changing market conditions based on objective, proven indicators from Ned Davis Research. As a result, you can have confidence even during down markets.

Idea #5: Charitable Lead Trust

What is a Charitable Lead Trust?

A Charitable Lead Trust (CLT) is an estate planning technique that benefits your charitable causes while leaving a tax-efficient inheritance to your children or grandchildren.

How does this strategy work?

You start with an irrevocable gift to a CLT. The CLT provides income to a charity of your choice for a certain period. It can also be during the grantor’s lifetime. Instead of specific charities, you can also give to a Donor Advised Fund (DAF), which gives you flexibility on when and what final charities benefit. The income can be a dollar amount or percentage of the trust value.

After the trust period, the remaining trust balance passes to children or grandchildren as an inheritance.

The CLT must be a non-grantor trust. This means that the trust, not the grantor, owns the assets. Otherwise, the trust would still be in the grantor’s estate. While the gift to your heirs is considered a taxable gift, you will receive an estate tax deduction for the gift to charity. Structured correctly, you face little or no estate tax consequences. This deduction allows you to leave even more to your heirs.

This strategy works best with low interest rates. Like the GRAT above, the payments to charity are based on the federal interest rate, which may be very different than the actual investment returns. If the investments outperform the low interest rates, the extra gains will go to your family.

Why would I use a Charitable Lead Trust?

A CLT can provide tax savings for you and for your family. There are often little or even no estate tax consequences.

For the charitably inclined, a CLT offers generous way to support both your family and your charitable causes. You can donate to your charity now and enjoy the benefits of your gift during your lifetime.

What pitfalls should I be aware of?

The CLT works best for individuals who are already charitably inclined. While a CLT offers tax benefits, the amount left to your heirs is reduced by the gift to charity.

Similar to the GRAT above, the investment allocation plays a key role. If the returns in the trust are lower than the charitable payments, the principal must be drawn down. This leaves less for your heirs. At Stratos Private Wealth, we can help you target an appropriate level of risk in the portfolio to give you confidence, regardless of what happens in the markets.

As with the other strategies above, a CLT must be coordinated with the rest of your financial plan. You need to ensure there is plenty left over for your financial needs. Also, this strategy works best when your family will not need the funds right away. If they will need access to the funds sooner than the end of the CLT term (such as for college expenses, a down payment on a first home, or staring a business), you may wish to consider another giving strategy.

Idea #6: Dynasty Trust

What is a Dynasty Trust?

A Dynasty Trust provides a lasting legacy that benefits your family for generations to come. It preserves your wealth from the erosion of estate taxes, irresponsible heirs, and creditors.

How does this strategy work?

Instead of leaving assets directly to children or grandchildren, you will establish a dynasty trust. The trust is irrevocable. This trust often has no specified ending date and so continues as long as assets remain. While the heirs don’t receive the money outright, they benefit through income or transfers based on their needs, depending on the language in the trust.

The trust faces gift taxes just once. (These taxes can be avoided if the gift is less than your exemption.) Because the assets stay in the trust and are not given outright to heirs, they avoid transfer taxes for each generation. On the other hand, if you gave outright to your children or grandchildren, the assets would face estate taxes when you make the gift and again when each heir passes away.

Why would I use a Dynasty Trust?

A dynasty trust is a powerful way to preserve money for future generations and maintain control. Each inheriting generation receives income for life. The principal is kept in the trust and continues growing.

This type of trust can work well to ensure that heirs will have funds to create fulfilling lives, without creating the need for them to assume the management of a large inheritance. It allows for the ability to protect future generations and to protect the inheritance.

Similarly, because the trust is never in the possession of your heirs, there is asset protection from lawsuits, bankruptcy, or divorce.

What pitfalls should I be aware of?

Is Control Really the Best Option? When deciding whether to use a dynasty trust, consider whether you want to limit the control of the assets for future generations. A dynasty trust gives the grantor control over how much and when distributions are made. The trade-off is that beneficiaries have very little control. Because they can’t tap into the principal, the funds may be unavailable for large ventures such as a home down payment or starting a business. Life can change quite dramatically over the years and generations that a dynasty trust may last, and a fixed trust may eventually not serve the best interests of your heirs.

Location Matters. Each state has different rules for dynasty trusts. Some states have laws against a trust continuing across multiple generations, while others allow them to continue 360, 500, or 1,000 years, or even perpetually. You can establish a trust in a state regardless of your current tax residency. However, these benefits may not last. There have been proposals, most notably the 99.5 Percent Act by Senator Sanders, would limit the transfer benefits to fifty years, even for existing trusts.

Protecting Social Benefits. Beneficiaries who receive social benefits (such as SSDI, SSI, or Medicaid) might lose these if they receive income from a trust. To protect these benefits, consider special needs language that would kick in only for disabled beneficiaries. Your estate planning attorney can help ensure this is included in your trust.

Selecting a Trustee with Longevity. You will likely need an independent trustee, such as a bank, who can continue providing services for decades into the future. You can also consider giving the trustee some discretion on changing the language of the trust to adjust to future changes to the tax code. Tax laws are constantly in flux. No one can predict what will happen in the next few years, not to mention the decades or even centuries that a dynasty trust may continue.

Giving up the Step-Up in Basis. Like some of the other trust structures mentioned above, the dynasty trust is irrevocable and so cannot be “undone” after the gift is made. Because the assets are outside of your estate, they do not qualify for a step-up in tax basis after your passing.

Is your Estate Plan in Order?

Your estate plan doesn’t exist by itself. These and other strategies must be considered along with the rest of your financial plan. More important than simply dodging taxes, we want you to live your best financial life and have the resources to fund it.

At Stratos Private Wealth, we partner with our clients to help them live richly – in alignment with your values and intentions. Through our 3-step process, we take prospective clients through a powerful exercise to understand their goals and values and create a draft financial plan to achieving them. We dive deep into every area of wealth management, including estate and tax planning, to check for blind spots and design creative solutions. Throughout this process, we partner closely with your legal and tax professionals to provide coordinated financial advice.