Time to Read: 8 Minutes

In our latest webinar, we discussed key factors we consider when determining if a market bottom has been put in, including:

- Oversold conditions

- Rally

- Retest of the lows

- Breadth thrusts

Here we take a closer look at breadth thrusts and four macro events in November that could spark a rally.

Breadth thrusts: Trust but verify

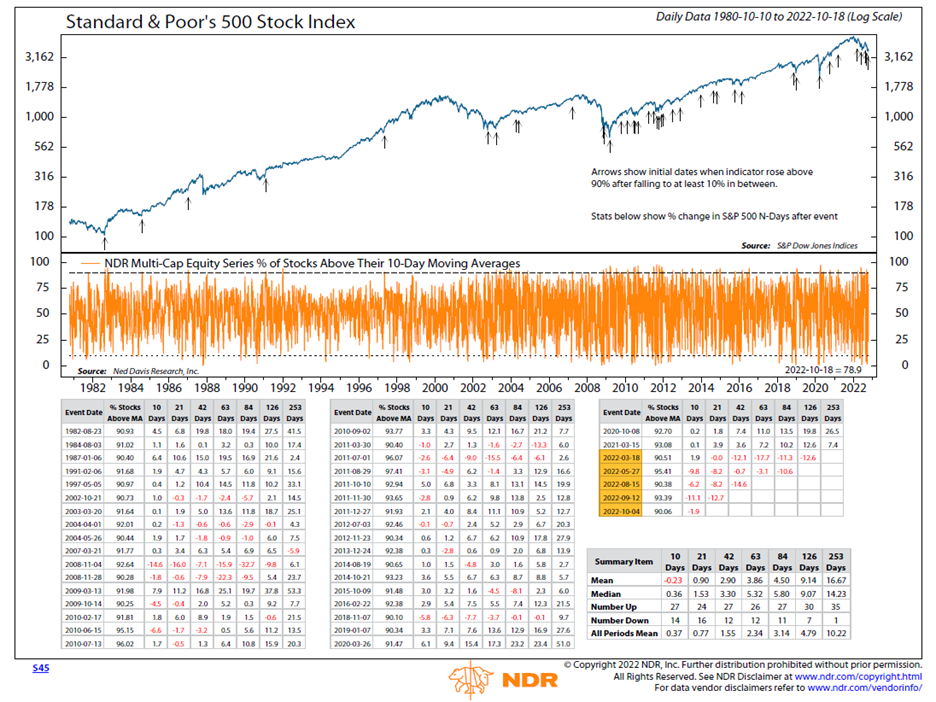

Strong rallies often start with a high percentage of stocks rallying together. When most stocks are above their moving averages, it’s less worrisome if a few stocks run into trouble—enough stocks should remain in uptrends to support the popular averages. For example, when the percentage of stocks above their 10-day moving averages has climbed above 90%, one year later the S&P 500 has been higher 35 out of 36 cases by a median of 14.2%, as shown below.

The chart arrows point to instances when more than 90% of stocks have been above their 10-day moving averages. This signal has flashed five times so far in 2022, second only to six times in 2011. The greater frequency of breadth thrust signals in recent years, and especially in 2022, has led us to adapt our mantra from “trust the thrust” to “trust but verify.”

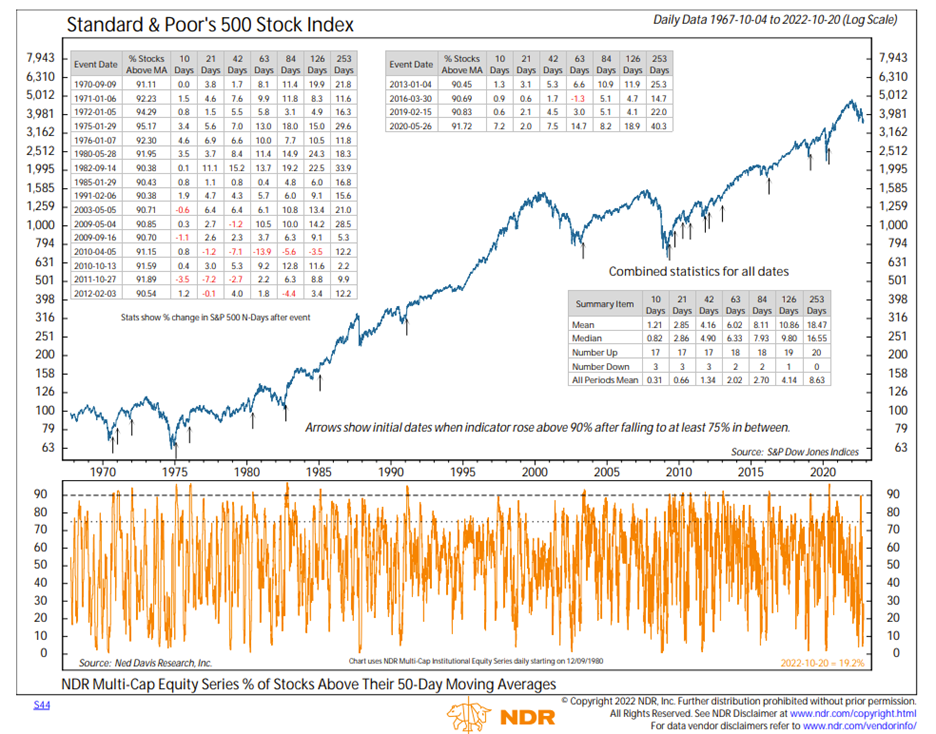

We verify by looking at intermediate-term and long-term breadth measures. For example, the percentage of stocks above their 50-day moving averages fell just short of the 90% signal threshold in August 2022, as shown below. The last time the signal was that close and fell short was October 1973.

Four macro events in November that could spark a rally

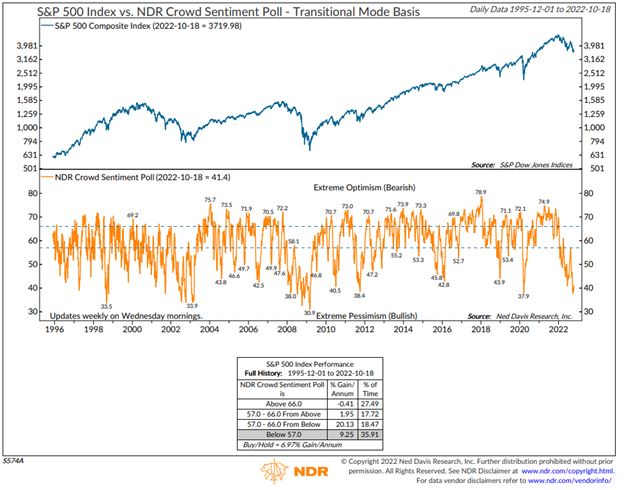

As we have noted multiple times, markets have been in a period of excessive pessimism for most of 2022. One way to look at intermediate-term sentiment is the Ned Davis Research Crowd Sentiment Poll, shown below.

As the chart illustrates, sentiment is typically a contrarian indicator. We are currently at the lowest levels since the early 2020 market bottom. Markets typically perform their best when reversing off an extremely pessimistic reading.

What is needed is a spark to ignite a rally—and we believe four key events on the macro calendar in the span of nine days have the potential to provide that spark:

- November 2 – FOMC meeting. The Fed is widely expected to raise rates by another 75 bps. For markets, the primary focus will be Chairman Jerome Powell’s press conference. Experts expect Powell will reiterate the Fed’s “data dependent” process and plans to make decisions meeting by meeting. If he suggests rate hikes may become smaller in the near future, markets may rally.

- November 4 – Employment report. Job openings have declined, yet unemployment claims remain low. Amid reports of staff and hiring reductions, it’s possible that job growth will come in below 200,000 instead of closer to 300,000. If so, markets may infer Fed tightening is softening the labor markets—so long as there isn’t an acceleration in wages.

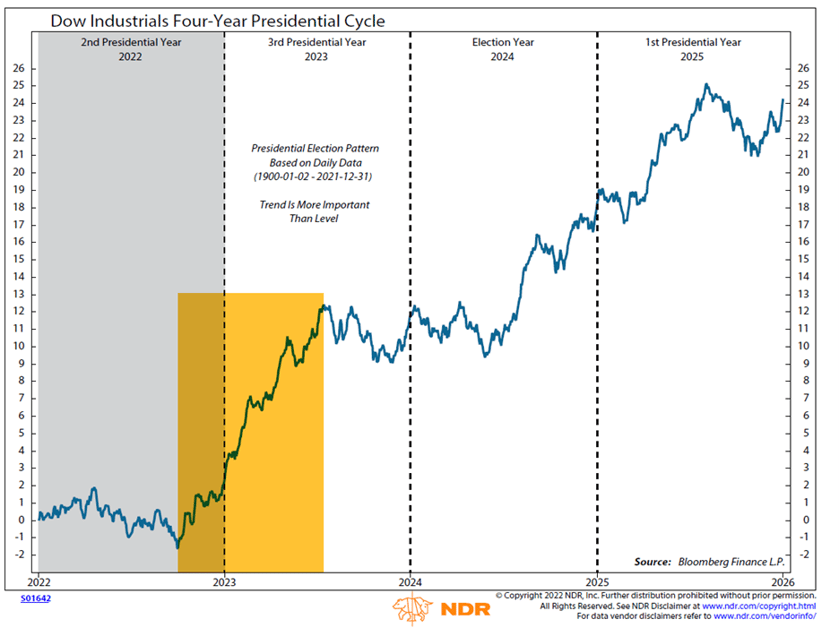

- November 8 – Election day. According to polls, legislative gridlock is the most likely outcome. In the second year of a four-year presidential cycle, the one-year period after an election has historically posted the strongest returns of the cycle, as shown below. Additionally, markets generally perform better over the longer term with gridlock.

- November 10 – CPI report. Markets may find further evidence that we’ve already passed peak inflation. A lower inflation print could be driven by lower input prices, improvements in supply chains, and declines in prices for consumer durables, apparel, and health insurance.

What this means for Stratos Private Wealth Clients?

At Stratos Private Wealth, we will be watching each event and the market response to see if any allocation adjustments are warranted. We will specifically be watching for more breadth thrusts and other intermediate-term technical measures to verify that a sustained rally is in place.

Investment advice offered through Stratos Wealth Partners, Ltd, a registered investment advisor; DBA Stratos Private Wealth. Stratos Wealth Partners and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only; and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision. Investing involves risk including possible loss of principal.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Stratos Private Wealth (“Stratos Private Wealth”)), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Stratos Private Wealth. Stratos Private Wealth is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Stratos Private Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.

Please Remember: If you are a Stratos Private Wealth client, please contact Stratos Private Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Stratos Private Wealth account holdings correspond directly to any comparative indices or categories.

Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Stratos Private Wealth accounts; and (3) a description of each comparative benchmark/index is available upon request.