Time to Read: 16 Minutes

Medicare can frustrate retirees trying to decode the “alphabet soup” of plan options. This decision is especially important for high earners who might have higher premiums. Thoughtful changes to your investments can help lower your monthly bill.

We at Stratos Private Wealth know how important it is to find the right Medicare plan. To assist you as Open Enrollment nears, we have created a guide that puts the confusing terms into plain English so you can understand your options. As needed, we can introduce you to Medicare experts who can put all the pieces together for you. We can also walk you through different ideas for your portfolio that might lower your premiums.

Ultimately, there is no one “right” Medicare plan. Your best Medicare plan depends on your unique situation, including your coverage needs, willingness to spend, travel plans, and desire for convenience.

Decoding the Medicare Alphabet Soup

We’ll start by discussing what Medicare Open Enrollment is and what options are available for high-income retirees.

What is Medicare Open Enrollment?

Open Enrollment is the annual period when you can switch to another Medicare policy.

What are the Medicare Open Enrollment dates for 2022?

Mark your calendar: 2022 Medicare Open Enrollment lasts from October 15th until December 7th, 2021. Your plan starts January 1st, 2022.

Change your mind? From January 1st to March 31st, 2022, those with Advantage Plan have a special chance to switch to another Advantage plan or to Original Medicare. Keep in mind, though, that you can only change policies once a year during this time.

Don’t let these dates slip by. After Open Enrollment, you must wait until next fall to change your coverage. Even if you’ve had your plan for years, you should review your coverage every year to see if another option better fits your healthcare needs or lowers your premiums.

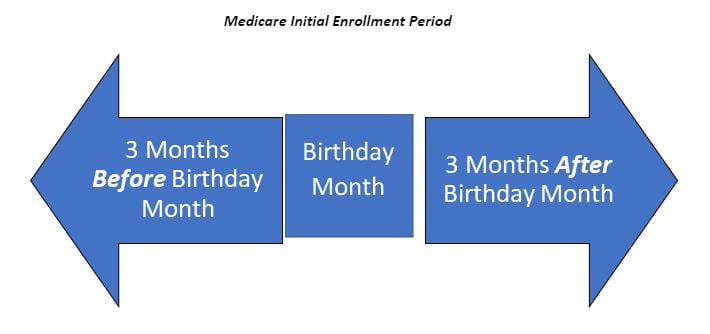

What is the initial enrollment period for Medicare?

When it’s your first time on Medicare, you have an initial enrollment period for 7 months. It starts 3 months before the month you turn 65, includes the month with your 65th birthday, and ends 3 months after the month you turn 65. For example, someone who turned 65 in July 2021 can sign up for Medicare anytime from April (3 months before July) to October (3 months after July).

Still working and want to stay with your current group plan? No problem. If you have a group policy when you turn age 65, there is also a special enrollment after that coverage ends. This lasts for 8 months after the month you are no longer covered. For example, if you retired and your coverage ended in February 2021, your enrollment period would last until October 2021.

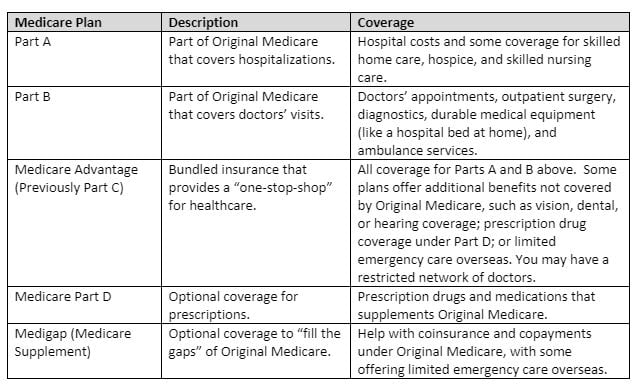

How many Medicare plans are available?

There are several different options for Medicare coverage, called Parts. This is where the dizzying “alphabet soup” of Medicare begins.

Part A. Original Medicare consists of two kinds of coverage: Part A and Part B. Part A provides coverage for hospital stays, nursing care, home health care, and hospice. Because Part A is covered through payroll taxes paid while you working, most people don’t pay a premium. Part A comes directly from the government.

Part B. The second part of Original Medicare, Part B, covers doctor’s visits. Like Part A, Medicare Part B comes directly from the government. Unlike Part A, however, it has a premium that rises along with your taxable income. We’ll describe this below. While Original Medicare Parts A and B covers many medical expenses, there are several important gaps. Certain services, including prescription drugs and vision, dental, and hearing care, are not covered. Travelers, beware! – international hospital bills are generally not covered. In addition, Original Medicare also comes with more out-of-pocket costs. For this reason, few retirees stick with just Original Medicare and instead choose to add other policies.

Part D. Medicare Part D is a common form of insurance which many people choose to purchase along with Original Medicare (Parts A and B). It covers some costs for drugs and other prescription medications. This coverage is optional and is purchased from an insurance company, not the government. The features and benefits depend on the policy you choose. While Part D covers more than Original Medicare alone, it won’t pay for all your prescription costs. Like most insurance policies, you must first pay a deductible every year before your policy starts covering your medications. After that, your Part D plan will begin to pay costs of drugs, but only up to a certain limit. Once that limit ($4,130 paid by you and your plan in 2021) is reached, you again start to pay out of pocket temporarily. This is called the Medicare Part D “donut hole.” Don’t worry, the “donut hole” doesn’t last forever. If you have very high drug costs ($6,550 out-of-pocket in 2021), your Part D insurance will start paying again as catastrophic coverage.

Here is a graphic that illustrates how this works:

To further “plug the gaps”, many also choose to purchase a Medigap plan (also known as Medicare Supplement Insurance). Medigap plans are private healthcare plans purchased along with Original Medicare. They are designed to lower what you pay out of pocket. Medigap policies don’t cover prescriptions, so you may also need a Part D plan. Some Medigap policies also offer emergency care overseas, a major advantage for international travelers.

Unrelated to the letter system for Medicare Parts, Medigap policies also come in a set of 10 plans: A, B, C, D, F, G, K, L, M and N. Each plan has a different premium. You don’t need to worry about memorizing these, as we will take a close look at a few of them later on.

Medicare Advantage

Instead of enrolling in Original Medicare (Parts A and B) and purchasing Part D and Medigap, some retirees choose a Medicare Advantage policy (previously called Medicare Part C).

Medicare Advantage plans are private health insurance plans that bundle Original Medicare (Parts A and B) with prescription drugs (Part D). It is a “one-stop shop” for your health care needs. Unlike Original Medicare, some Advantage plans offer vision, dental, and hearing. Advantage plans are also very cost-efficient. Unlike Medigap plans, Medicare Advantage plans usually have no premiums.

The biggest downfall to Medicare Advantage is that you can’t use it everywhere. While Medigap plans are accepted by all doctors who take Medicare, Advantage plans usually have a limited number of doctors. Before signing up for a Medicare Advantage plan, make sure your favorite doctors are covered by your plan.

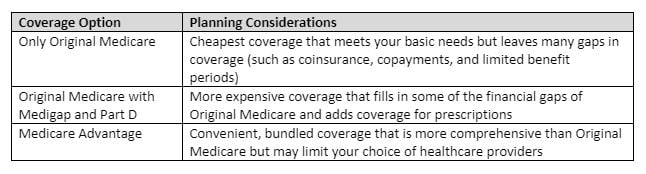

What Medicare coverage is best for high income earners?

There is no single “perfect Medicare plan” for high earners. Instead, it is a highly personal decision that depends on the coverage, cost, and convenience that you prefer.

Before delving into Medicare, first consider all your health care choices. If you’re still working, you may get cheaper insurance through a group plan. Your employer might also offer a Medigap policy. If your spouse is still working, you may also be eligible for coverage under their plan. If you have both Medicare and another healthcare plan, there are “coordination of benefits” that determine which plan covers your bills.

Most retirees find that Original Medicare by itself doesn’t fully meet their needs. Most choose between two main options: Original Medicare with Part D and a Medigap supplement policy, or a Medicare Advantage Plan. We’ll dive into the pros and cons of each.

Option #1: Original Medicare with Part D and Medigap

Most high earners choose Original Medicare with Part D and a Medigap policy. This gives you the most flexibility.

The biggest drawback is cost. High earners will need to pay premiums for Part B, Part D, and Medigap. Since Medigap can’t offer vision, dental, or hearing coverage, you will also need to pay for these services out-of-pocket.

If you decide to purchase a Medigap policy, which should you choose? For many years, the most popular plan for high earners was Plan F. It is the most comprehensive Medigap plan available. After 2019, however, Medigap Plan F is no longer open to new enrollees. (Those already on Plan F can rest assured – you are grandfathered in and never need to switch plans.) Many new enrollees now choose Plan G since it provides most of the same generous benefits as Plan F.

Option #2: Medicare Advantage

A Medigap policy isn’t always the best option, however. For some enrollees, especially those without chronic conditions, signing up for Medicare Advantage makes a lot more sense. Medicare Advantage is a simple solution that bundles your coverage into one convenient policy. Furthermore, Advantage plans can offer dental, vision, and hearing coverage, not offered through Medigap policies. If you are considering a Medicare Advantage plan, make sure your favorite doctor is in-network, since many do not accept Advantage plans.

Reducing Medicare Premiums for High Earners is About Managing Income

How much you pay for Medicare depends on your income. For most high-income retirees, this comes mainly from investments. The types of investments you hold, as well as accounts you have, can dramatically affect what you pay for coverage.

Do high income earners pay more for Medicare?

Yes, the cost of Medicare premiums rises along with your income.

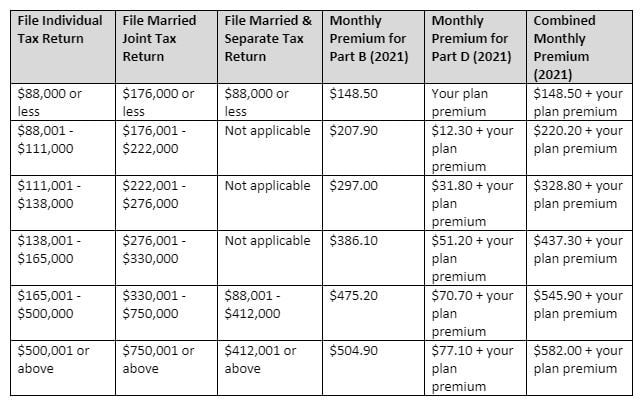

What are the income limits for Medicare in 2021?

While anyone can be enrolled in Medicare, premiums rise along with your income.

First, some good news – the cost of Part A is covered by your payroll tax, so you probably won’t see a bill.

Part B and Part D both have premiums that depend on your income. Your monthly Part B premium (physician’s services) ranges from $148.50 to $504.90, and your monthly Part D premium (prescription medications) ranges from $0 to $77.10. This means that earners at the top limits could pay an additional $5,202/year for Parts B and D in 2021. Note that your income is based on your most recent tax return. This is usually your income from 2 years ago. As an example, for your 2021 premiums, Medicare will use the income on your 2019 tax return.”

For retirees near the limits, reducing your taxable income can have the double benefit of lowering taxes as well as knocking down your Medicare premiums. Since most retirement income is from investments, we’ll pay special attention to portfolio income.

How can a Roth conversion reduce my Medicare premiums?

A Roth conversion can reduce your Medicare premiums in future years. Every year starting at age 72, you are required by law to take a certain amount out of Traditional (pre-tax) retirement accounts, such as your IRA, 401(k), or 403(b). These distributions are called Required Minimum Distributions (RMDs).

Many high-net-worth retirees will have to withdraw more than they need for everyday living expenses. This will inflate their taxable income and thrust them into higher tax brackets and Medicare premium rates.

One way to reduce this is through a Roth IRA conversion. A Roth IRA holds tax-free dollars and doesn’t have any RMDs. Anyone can convert assets from a Traditional IRA or 401(k) to a Roth IRA at any time, no matter your income. Because a Roth conversion leaves less in your taxable IRA or 401(k), it lowers future required withdrawals and can knock down your Medicare premiums overtime.

All of these benefits come with a cost – while a Roth conversion can help you save on future taxes, it will increase your income in the year you convert. The amount converted is treated as ordinary income. Because of this, a Roth conversion works best in a year with unusually low income (such as when your income is offset by a large charitable gift or business loss). It can also be a great strategy for those not yet required to take retirement account withdrawals. Roth conversions can also be spread over a few years to reduce the tax bite in any one year. At Stratos Private Wealth, we are always on the lookout to balance the conversion amount just right to keep clients from hitting the next tax bracket.

We can even help you plan for Medicare premiums before you retire! Our Holistiplan software maps out your projected Medicare premiums and models the impact of a Roth conversion, including both the higher taxes in the year you convert as well as savings in future years. We will then work with your accountant to design a custom plan for reducing your Traditional IRA balances over time.

How can Charitable Distributions impact my Medicare premiums?

Another great IRA strategy for the charitably-inclined is the Qualified Charitable Distribution (QCD). This kind of distribution can be a great way for high-income retirees to reduce their tax burden and support their favorite charities at the same time.

A QCD is a direct transfer from your IRA to charity. While you don’t receive a tax deduction, your full gift (up to $100,000) is excluded from income. This means your taxable income – and possibly Medicare premiums – will be lower than they would be otherwise. Another great benefit: the QCD gift counts toward your Required Minimum Distributions, which can work well for retirees who don’t need the full amount for living expenses.

Do municipal bonds increase my income for calculating Medicare premiums?

Municipal bonds (bonds issued by local or state governments) are a popular investment for high-income retirees. The bond interest is tax-free for federal taxes, and if issued by your state, it might also be tax-free for state taxes.

Even if tax-free, the amount is still included in your income for calculating Medicare premiums. As a result, a retiree with a lot of municipal bonds may be in a low federal tax bracket but pay high Medicare premiums. While this doesn’t mean a retiree should sell all municipal bonds, they should be given special consideration.

With higher Medicare premiums, municipal bonds may not offer the best overall return. We assist clients in reviewing their portfolio. We’ll consider the trade-off between owning municipal bonds and other types of fixed-income investments, such as corporate bonds, real estate investment trusts, and many others.

What else should I plan for in retirement?

As we have seen, these strategies can help you save on Medicare premiums over time. This doesn’t mean, however, that you should let Medicare premiums drive your investments. While important, they must be balanced against other important areas of your retirement income planning.

What Else Do I Need to Know About Medicare?

How does travel impact my Medicare coverage?

Planning a world cruise, summer in Europe, or an extended stay with family in Asia? See how that will affect your Medicare coverage. Original Medicare (Parts A and B) generally won’t apply outside the U.S., leaving you on the hook for 100% of the bill. This restriction applies to international medications as well as care received aboard most cruise ships away from a U.S. port, even if you have a medical emergency.

Most Medigap policies (Plans C, D, E, F, G, H, I J, M, and N) and Medicare Advantage Plans will provide emergency coverage abroad. If you’re not covered, consider a travel health insurance plan.

Thinking about moving out of state? While Original Medicare (Parts A and B) is the same nationwide, Medicare Advantage is limited. If you move to a new area where your plan isn’t covered, or where new options are available, you have a special enrollment period for signing up for another plan. This lasts the month before you move and 2 months afterwards.

Can you have an HSA with Medicare?

Yes and no.

A Health Savings Account (HSA) is an easy tax-savings strategy that affluent investors should consider. Saving into an HSA gives you a federal tax deduction. The funds also grow tax-free when used for medical costs.

Those with an existing HSA can still use the funds while on a Medicare plan. You cannot, however, add any additional savings.

When can I enroll in a Medigap plan?

The best time to enroll in a Medigap plan is during your initial enrollment period when you first sign up for Medicare Part B. If you enroll afterwards, you will usually need to qualify for the plan through medical underwriting. This means that there is no guarantee that you will be accepted, or your premiums may be significantly higher.

Our San Diego clients can take advantage of California’s “Birthday Rule.” This allows current Medigap enrollees 60 days every year to purchase a new Medigap policy without underwriting. The benefits must be the same or less than your old policy. The ability to qualify without an examination makes this a valuable opportunity to shop for a policy that better fits your needs.

What happens if I miss the Medicare deadline?

Bad news for procrastinators – your Medicare premiums could be permanently higher if you wait too long. Premiums for Part B can go up as much as 10% for every 12 months you could’ve had coverage but didn’t sign up yet. For Part D, a late 1% penalty is charged every month starting after you’re more than 2 months (technically 63 days) late. These penalties last as long as you have Medicare Part B or Part D. They will not, however, affect you if you had other coverage during these periods, such as through an employer group plan.

How Can I Ensure I Have the Right Medicare Policy?

As discussed above, many factors are involved in deciding which Medicare policy best fits your needs. In addition to finding the right coverage, you can take steps to make sure your portfolio doesn’t bump you into a higher Medicare premium rate. We’d be happy to offer a free review of your investments. Our goal is to ensure you have the right Medicare plan in place to enjoy your retirement with full peace of mind.