Still Overweight Equities in an Uncertain Environment

While 2023 started out with a powerful rally in January, the environment has since become much more nuanced after the failures of Silicon Valley Bank and Signature Bank. At Stratos Private Wealth (SPW), we are still overweight equities relative to our benchmarks as both US and international stocks have outperformed bonds and cash over the year-to-date period. In this article, we look at a few of the reasons we remain overweight equities despite the negative headlines.

The trend: Positive

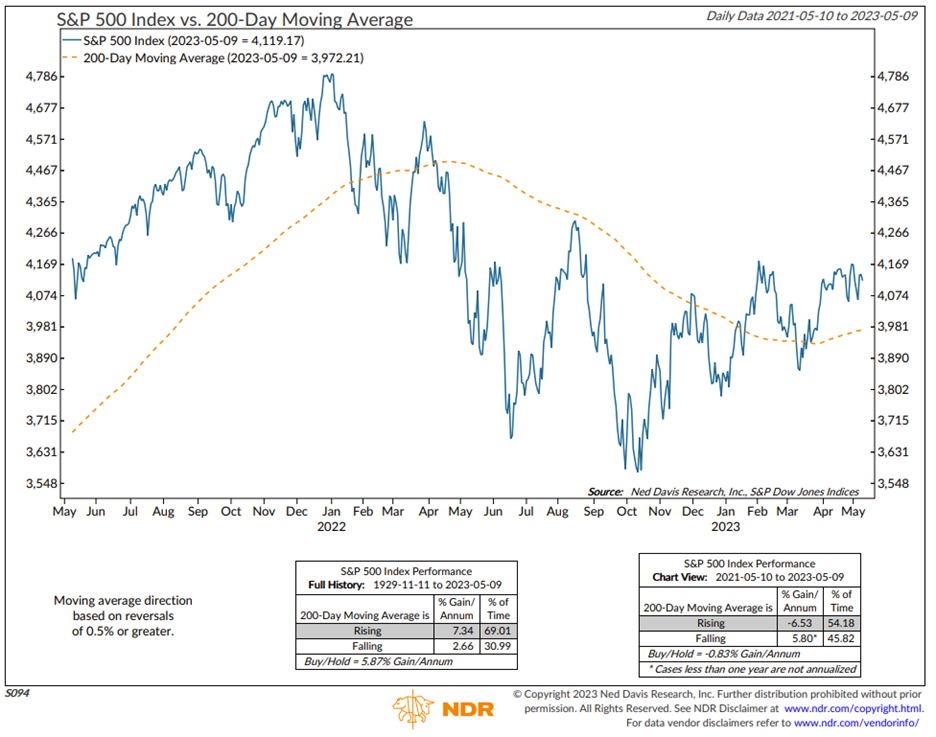

“Don’t fight the trend” is one of our primary tactical rules of investing. One way to analyze the trend is to look at the 200-day moving average. The 200-day moving average is a technical analysis indicator commonly used in the stock market to gauge the overall direction of a stock or index price trend over the long term. It is calculated by adding up the closing prices of a stock or index over the past 200 trading days then dividing the sum by 200.

Traders and investors use the 200-day moving average as a tool to help identify potential trends and key levels of support and resistance. If the price of a stock or index is trading above its 200-day moving average, it is generally considered to be in an uptrend, while trading below indicates a downtrend.

The chart below plots the price of the S&P 500 (blue line) against its 200-day moving average (orange line). We can see two key positives: Not only is the S&P 500 firmly above its 200-day moving average, but the 200-day average is now moving up. Together, these are positive technical indicators for the market’s current momentum.

Beware the crowd at extremes: Positive

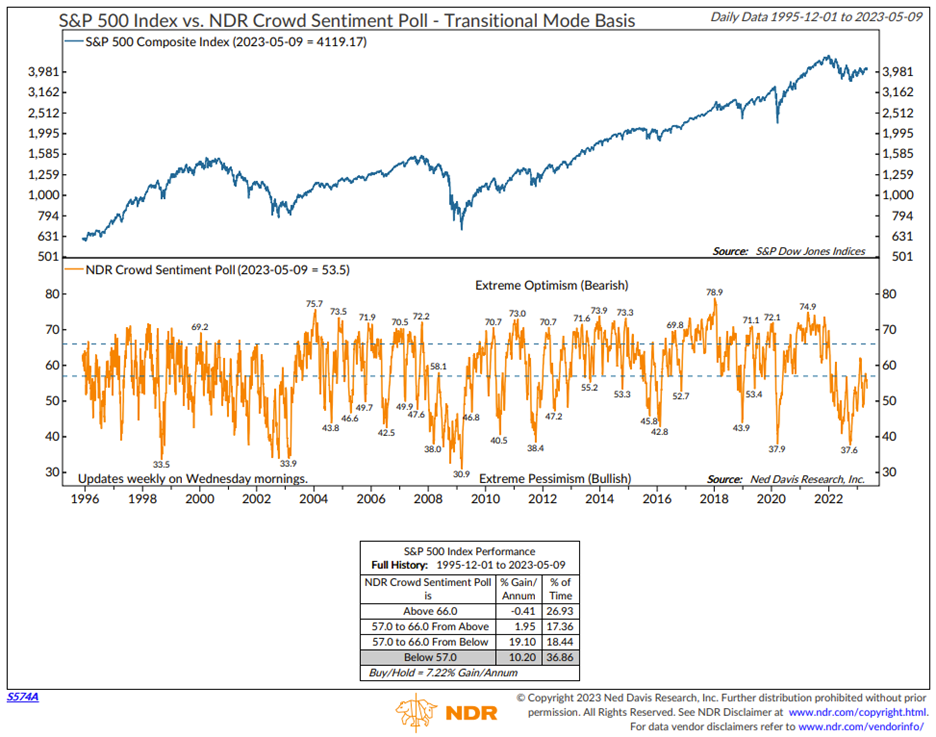

“Beware the crowd at extremes” is another one of our key tactical rules. This phrase is used by our research provider, Ned Davis Research (NDR), and essentially means investors should be cautious when markets are showing extreme sentiment, whether extreme optimism (a bearish indicator) or extreme pessimism (a bullish indicator). From NDR’s point of view, the phrase reminds us markets are driven by human emotions and behavior, which can often lead to irrational and extreme movements. When the crowd is moving in one direction, it can create a herd mentality where investors follow the trend without fully understanding the underlying fundamentals of the market.

As shown below, one of the crowd-tracking metrics published by NDR—the Crowd Sentiment Poll—is currently in the extreme pessimism range, which we view as a bullish sign for the market. Furthermore, the metric has been in the pessimistic zone for most of the last 14 months, which shows just how pessimistic the crowd has been. We think this dynamic provides room for an upside move when the news cycle and fundamentals get more positive.

Don’t fight the Fed: Negative … for now

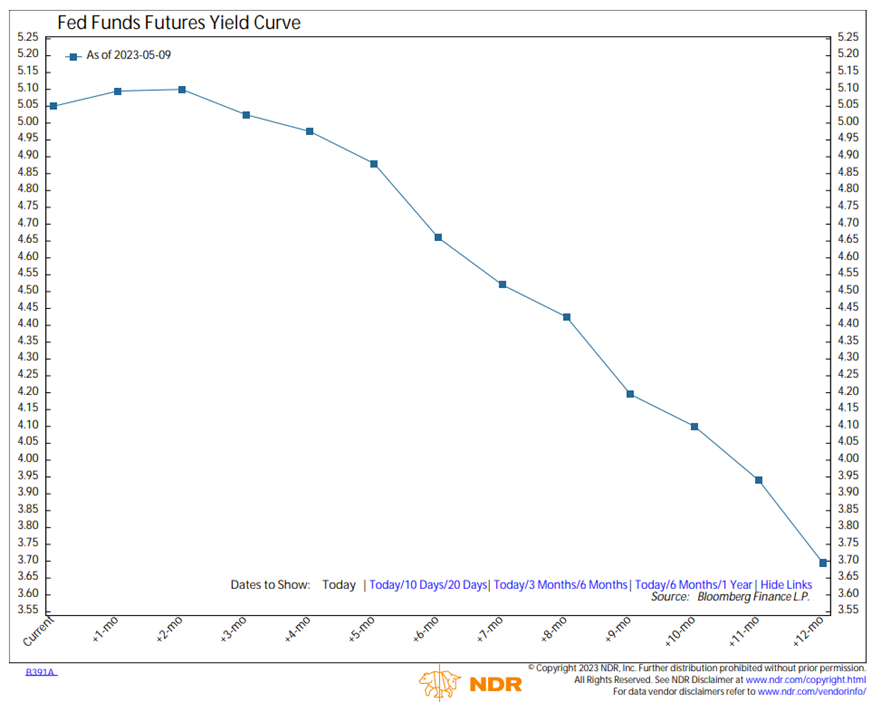

"Don't fight the Fed" is a phrase used in investment circles that means investors shouldn’t take positions contrary to the actions or signals of the Federal Reserve (Fed). From NDR’s point of view, this phrase suggests the Fed has a powerful impact on financial markets, and investors who try to bet against the Fed's actions can have downside risk. Since the Fed is responsible for setting monetary policy in the US—a purview which includes managing interest rates, controlling inflation, and promoting economic growth—the actions and statements of the Fed can have a significant impact on financial markets, including the stock and bond markets.

Fed actions heavily influenced markets in 2022. After initially calling inflation transitory, which allowed markets to think interest rate hikes would be mild, the Fed’s narrative began to change, and the stock and bond markets moved sharply lower.

The Fed hiked rates again on May 3rd by 25 basis points—but we believe the central bank may be at the end of its rate-hiking cycle. In fact, looking at the Fed funds futures yield curve shown below, we see the market is pricing in significant rate cuts by the Fed over the next 12 months. Only time will tell, but this has the potential to bode well for the market.

What about the debt ceiling?

There has been a lot of news around the upcoming debt ceiling and a possible event if something is not done before June 1st. Over the years, market stakeholders have grown accustomed to the belief that any deadlock over the debt ceiling will inevitably be resolved in time to prevent a default, even if it goes down to the last minute. This belief is rooted in their trust that politicians are aware of the potentially catastrophic consequences of a default, which could destabilize the global financial system and possibly trigger a recession in both the US and global economy. Consistent with this pattern, Congress has dependably raised the debt limit, even in instances where the Treasury was operating on bare resources, employing "extraordinary measures" to keep the debt within the prescribed limit.

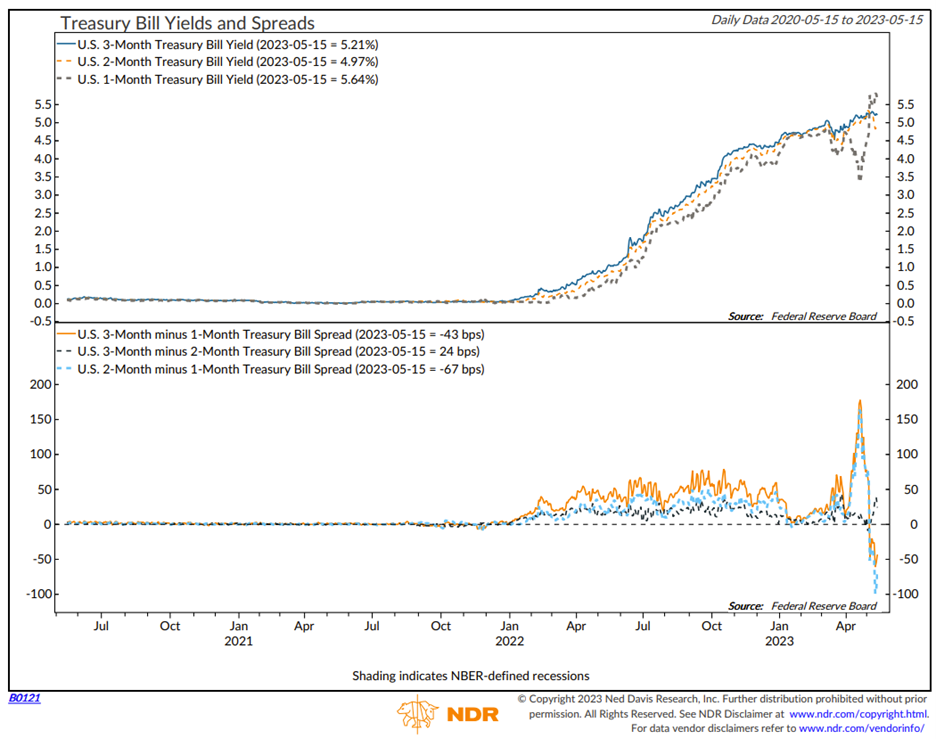

Although we anticipate another adjustment to the debt limit, there's a substantial likelihood of financial market fluctuations between the present time and the projected X-date of June 1st, according to Treasury estimates. The current scenario echoes the events of 2011 when a split Congress and a Democratic president almost led the nation to default. This episode of political brinkmanship partially contributed to the decision by Standard and Poor’s to downgrade the US from its AAA rating. We hope that politicians have learned their lesson not to go too far.

The uncertainty surrounding the debt ceiling is already affecting certain segments of the money market. For instance, T-Bills due in early June have yields nearly 100 basis points higher than those maturing just a month later, as illustrated in the chart below.

Despite President Biden's optimistic outlook on the negotiations, the two sides are still significantly at odds. This isn't a question of the capacity to raise the debt ceiling, but rather the willingness to do so.

Ideally, a negotiated agreement to raise the debt limit would be the best outcome. But what happens if consensus isn't reached? Are there any actions the Treasury and the Fed could take to avert a default? Treasury Secretary Yellen has remained somewhat elusive about alternative strategies.

While Fed Chairman Powell maintains this is a fiscal issue outside the Fed's jurisdiction, the Fed also bears responsibility for financial stability. Can the Fed just sit back and potentially witness a systemic collapse? It's unlikely. Some suggest that the 14th Amendment, which stipulates the public debt of the US "shall not be questioned," comes into play. This would inevitably lead to a legal challenge, which would be escalated to the Supreme Court for definitive resolution.

We thought it would be interesting to present a range of less dramatic solutions which could be employed to prevent an outright default, and may or may not be entirely legal:

- The Fed's holdings of publicly-held Treasury's could be reclassified so they are not subject to the debt limit.

- Principal payments could be delayed by moving forward the operational maturity date.

- The Fed could purchase all debt at risk of default and sell debt that isn't at risk.

- Perpetual or consul bonds could be issued, which don't require principal repayment.

- A large platinum coin could be minted, given the Treasury has the ability to create money.

- High coupon bonds could be issued, which would sell at a premium to par.

- The gold stock could be revalued to current prices, and gold certificates could be issued.

Bottom line

As we stated earlier, we still remain overweight equities in our tactical portfolios as the weight of the evidence leans bullish. Investors with excess cash might want to use potential volaltility as an opportunity to add to risk assets over the next few weeks should the debt ceiling create better entry points.

If our indicators begin to break down as a result of the debt impasse or anything else, we will adjust accordingly.

Stratos Private Wealth is a division through which Stratos Wealth Partners, Ltd. markets wealth management services. Investment advisory services offered through Stratos Wealth Partners, Ltd., a registered investment adviser. Stratos Wealth Partners and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only; and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision. Investing involves risk including possible loss of principal. Some of the information contained herein has been obtained from third party sources which are reasonably believed to be reliable, but we cannot guarantee its accuracy or completeness. The information should not be regarded as a complete analysis of the subjects discussed.

%20(2000%20%C3%97%201260%20px).png?width=300&name=Featured%20Image%20(2240%20%C3%97%201260%20px)%20(2000%20%C3%97%201260%20px).png)