Fewer Rate Cuts 2024?... And it could be a good thing.

Since the last Federal Open Market Committee meeting on January 30-31, the Federal Reserve (Fed) made clear it is not planning to reduce the crucial federal funds rate—which influences borrowing costs for individuals and businesses—at its March meeting. The message was delivered through various communications, including Jerome Powell’s appearance on "60 Minutes" and speeches by several Fed officials. However, if inflation continues to decrease towards the Fed's goal of 2%, we might see rate cuts later this year.

Understanding the Fed’s recent signals

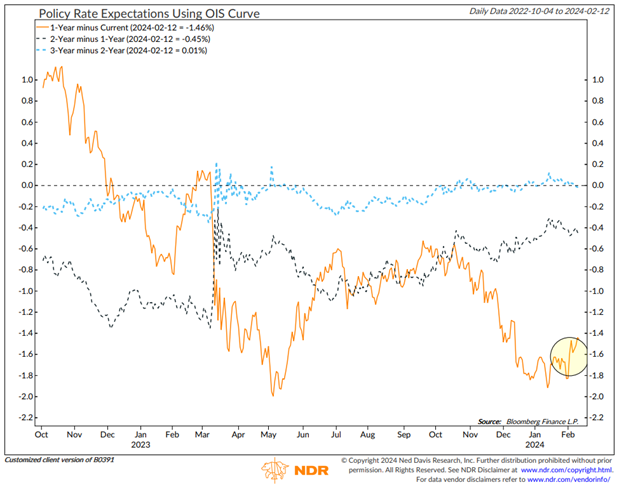

In our latest webinar, we discussed how market expectations had perhaps gotten ahead of themselves with regard to the timing and speed of rate cuts in 2024. In the chart below, the orange line shows the spread between the expected federal funds rate 12 months out and the current policy rate moved from -1.8% in January to -1.46% as of February 2. This indicates market participants are now expecting about one less rate cut in the year ahead.

How do rate cuts influence stocks? Speed matters

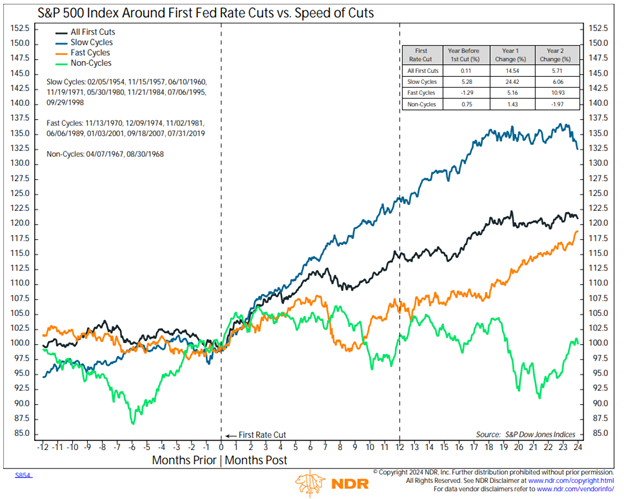

Historically, when the Fed has started cutting rates, it has often been good news for the stock market: Stocks have typically increased in value after the first rate cut. How much they increase can depend on the economic context at the time of the cut. For example, if the economy is just slowing down but not entering a recession—a soft landing—stocks tend to do very well. But if the economy heads into a recession within a year of the initial cut, the boost to stocks is generally weaker.

The pace of rate cuts also matters. Despite some investors expecting up to six rate cuts, the Fed suggests it might implement fewer cuts if economic growth remains strong. While fewer cuts might seem like bad news for stocks (given that higher bond yields could attract investors away from stocks), a slower pace of rate cuts has historically been positive for the stock market: A measured approach by the Fed signals confidence in the economy's strength, reminiscent of the situations in 1984, 1995, and 1998.

Conversely, when the Fed cuts rates quickly—as it did in the periods following 2001, 2007, and 2019—the impetus is often significant economic distress. The chart below from Ned Davis Research illustrates that slow easing cycles with less than five cuts in 12 months have been accompanied by an average first-year rise in the S&P 500 Index of 24.4%, compared to only 5.2% during rapid cut cycles, which are marked by higher volatility. We also see the market tends to recover in the second year after rapid cut cycles.

Looking ahead

The Fed’s current stance suggests a cautious openness to support the economy, if necessary, but only if inflation trends stay on the desired trajectory. While immediate rate cuts might not be on the table, this scenario presents investors with the potential for positive stock market performance, especially if the Fed's actions lead to a soft landing for the economy. Inflation data over the coming weeks and the market’s interpretation of the data will have a meaningful impact on the future of Fed policy as well as market returns.

Stratos Private Wealth is a division through which Stratos Wealth Partners, Ltd. markets wealth management services. Investment advisory services offered through Stratos Wealth Partners, Ltd., a registered investment adviser. Stratos Wealth Partners and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only; and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision. Investing involves risk including possible loss of principal. Some of the information contained herein has been obtained from third party sources which are reasonably believed to be reliable, but we cannot guarantee its accuracy or completeness. The information should not be regarded as a complete analysis of the subjects discussed.

%20(Blog%20Banner)%20(1).png?width=300&name=March%20Webinar%20cover%20(2%20%C3%97%201%20in)%20(Blog%20Banner)%20(1).png)